January 17th 2022: EV Metals Group plc (EVM) has today launched the Australian Lithium Alliance, a strategic initiative to partner with Australian companies to accelerate exploration, development, mining, processing and production of Lithium Minerals.

The strategic initiative will be implemented by Australian Lithium Alliance Pty Limited (ALA), a wholly owned subsidiary of EVM, through joint ventures and off-take agreements as an alternative to Chinese companies that currently dominate the purchase of spodumene concentrate from Australia to supply chemicals processing companies in China.

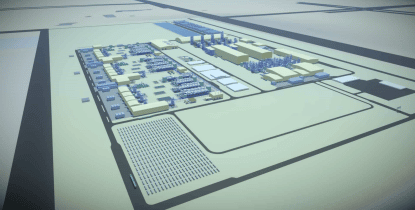

EVM is building a global battery chemicals and technology business with the development of the world’s first integrated Battery Chemicals Complex (BCC) at Yanbu Industrial City in the Kingdom of Saudi Arabia. It will produce high purity chemicals containing lithium, nickel, cobalt, manganese and other metals required for high energy density cathode active materials used in rechargeable lithium-ion batteries for electric vehicles and renewable energy storage.

Eng. Abdullah S. Busfar, Chairman of EVM comments, “The Australian Lithium Alliance is a strategic global initiative to secure the upstream integration of supply chains for critical raw materials required to fast track the development of the BCC in the Kingdom.”

“The BCC is being developed as a midstream and downstream global hub for production of high purity chemicals and cathode active materials for domestic and export sales to original equipment manufacturers and battery cell manufacturers in growth markets in Europe and North America seeking stable, long term, independent and transparent supply chains as structural deficits emerge in lithium after 2025.”

EVM is in a unique position with the development of two processing trains requiring initially 330,000 tpa of spodumene concentrate containing 6% lithium oxide (SC6) to produce 50,000 tpa of lithium hydroxide monohydrate (LHM) in the Lithium Chemicals Plant at the Battery

Chemicals Complex in the Kingdom of Saudi Arabia. The BCC has been designed for expansion with a further two trains requiring a further 330,000 tpa of SC6 for the production a further 50,000 tpa of LHM.

EVM launched the formation of the Australian Lithium Alliance with the release of details of an agreement in the form of an Earn-in Joint Venture and Lithium Rights Deed (Agreement) between EVM, ALA, Zenith Minerals Ltd (ZNC) and Black Dragon Energy (Aus) Pty Limited (BDE), a wholly subsidiary of ZNC.

The terms of the Agreement are outlined in the Announcement by ZNC (ASX Code: ZNC) to the Australian Securities Exchange (ASX) dated 13 January 2022, a copy of which can be found here.

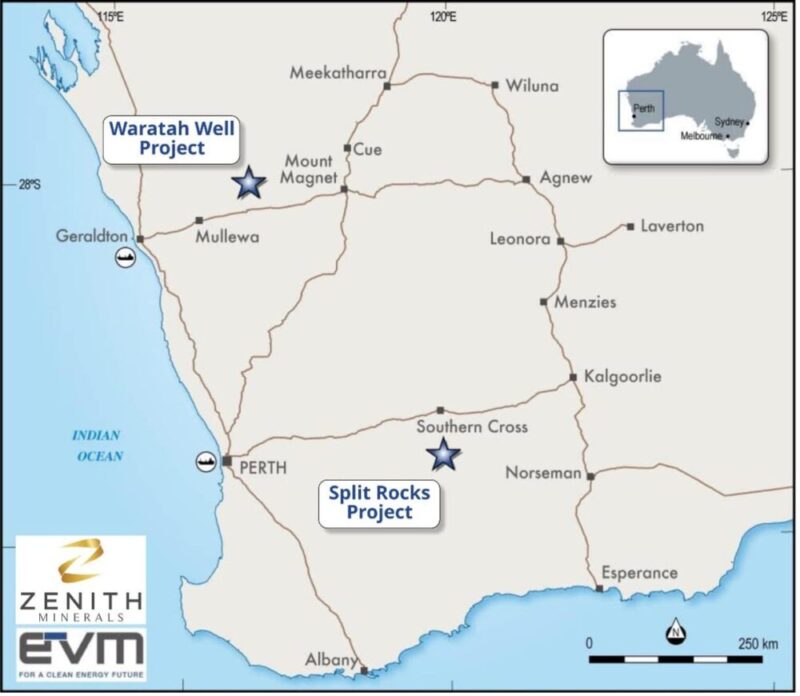

The Agreement will accelerate the exploration for and, if successful, the development, mining, processing and production of Lithium Minerals from the strategically located Split Rocks and Waratah Well Tenements under the Zenith Lithium Joint Venture. EVM will also enter into a life of mine offtake agreement for all production of SC6 from all Lithium Minerals Projects developed by the Zenith Lithium Joint Venture.

Under the Agreement Lithium Minerals include ‘lithium (in any and all forms) and all other metals including tantalum, caesium, all rare earth elements, nickel, cobalt, copper and scandium in the Tenements but specifically excludes gold, silver and other precious minerals however they may occur’.

Michael Naylor, Managing Director of EVM comments, “The aim is for the Australian Lithium Alliance to build the Zenith Lithium Joint Venture into the largest producer of Lithium Minerals in the form of spodumene in Australia.”

“The Agreement with ZNC is an exemplary working model. Australian Lithium Alliance will fund all expenditure for completion of a feasibility study for the development of a Lithium Minerals Project to earn an interest of 60% in the Zenith Lithium Joint Venture and all Lithium Minerals Projects acquired by the Lithium Joint Venture.”

“EVM will fund ZNC’s share of all capital expenditure for the development and commissioning of a Lithium Minerals Project which will be repaid by ZNC from its share of Lithium Minerals products on the same terms as project finance secured by EVM.”

“ZNC is a standout strategic fit and a first mover for the Australian Lithium Alliance. ZNC is led by Director, Stan Macdonald and CEO, Mick Clifford, who have a strong track record of success in project generation, acquisition and exploration for minerals in Australia. ZNC has been listed on ASX for about 15 years. It is debt free with a valuable project portfolio of advanced exploration projects for lithium, gold and base metals in Australia.”

“EVM will work with ZNC through the Australian Lithium Alliance to develop ZNC as a pure Lithium Minerals company and leading producer of SC6, the preferred feedstock for the production of lithium monohydrate by the Lithium Chemicals Plant in the Battery Chemicals Complex.”

“ZNC and the Zenith Lithium Joint Venture is strategically positioned to access the first two trains of LHM in the Lithium Chemicals Plant which are scheduled for commissioning in the second half of 2024.”

“We are moving to fast track the evaluation and development of a Lithium Minerals Project through the Zenith Joint Venture to meet the schedule for SC6 feed for the first two trains of LHM.”

For media enquiries

Hannah Newberry, Communications and Media Manager:

E hannah.newberry@evmetalsgroup.com

For EVM enquiries

Michael Naylor, Managing Director, EV Metals Group plc

E michael.naylor@evmetalsgroup.com

About EV Metals Group

EV Metals Group plc (EVM) is building a global battery chemicals and technology business based on the development of the Battery Chemicals Complex in the Kingdom of Saudi Arabia.

EVM is focused on the development of the Battery Chemicals Complex to be become a global leader in the production high purity chemicals containing lithium, nickel, cobalt, manganese and other metals for high energy density cathode active materials required in rechargeable lithium-ion batteries for electric vehicles and renewable energy storage.

EVM will fast track the staged development and expansions of the Battery Chemicals Complex to include four processing trains in the Lithium Chemicals Plant to produce 100,000 tpa of lithium hydroxide monohydrate (LHM) and three processing trains in the Nickel Chemicals Plant to produce 450,000 tpa of nickel sulphate.

EVM will complete front end engineering and design (FEED) in Q4 2022 and start construction of the first two processing trains for production of lithium hydroxide monohydrate for the Lithium Chemical Plant in 12 months; that is, in Q1 2023.

EVM has offices in Al Khobar, Saudi Arabia, Perth, Western Australia and London, United Kingdom. For further information on EVM please visit www.evmetalsgroup.com.

Figure 1 – joint venture locations

Figure 2 – EVM’s Battery Chemicals Complex in KSA

About Zenith Minerals Ltd

In addition to its lithium assets at Split Rocks and Waratah Well, Zenith Minerals Limited has a portfolio of gold and base metal assets in Western Australia and Queensland.

A new major zinc discovery at Earaheedy in Western Australia is to be fast tracked with extensive accelerated exploration programs underpinned by a recent $40M capital raising by partner Rumble Resources Limited (ASX:RTR) (ASX Releases 28-Apr-21, 2-Jun-21, 8-Jun-21, 18-Oct-21, 13-Dec-21 and 21-Dec-21).

In Queensland an Inferred Mineral Resource 2.57Mt @ 1.76% Cu, 2.01% Zn, 0.24% Au & 9.6g/t Ag (ASX Release 15-Feb-15) underpins the Company’s Develin Creek massive copper zinc sulphide project. Recent 2021 drilling intersected massive copper-zinc sulphides at 2 new prospects, Wilsons North & Snook, a testament to the prospective nature of the extensive landholdings.

At Red Mountain in Queensland, drilling programs are planned to follow-up the high-grade near surface gold and silver intersected in Zenith’s maiden & subsequent drill programs (ASX Releases 3-Aug-20 & 13-Oct-20, 9-Nov-20, 21-Jan-21 and 19-May-21).

Drilling returned high-grade near surface gold mineralisation at multiple targets in the Split Rocks gold project in the Western Australian goldfields (ASX Release 5-Aug-20, 2-Sep-20, 19- Oct-20, 28-Oct-20, 15-Jan-21, 11-Mar-21, 21-Apr-21, 24-Jun-21, 30-Sep-21).

Agreement between Royal Commission for Jubail and Yanbu and EV Metals Group

On 6 October 2021, EV Metals Group plc outlined plans for the development of the Battery Chemicals Complex in Yanbu Industrial City following the Conditional Investment Agreement signed between Royal Commission for Jubail and Yanbu and EV Metals Arabia Co. for Industry (EVM Arabia).

The Royal Commission for Jubail and Yanbu was established in 1975 to plan, promote and manage petrochemical and energy intensive industrial cities in the Kingdom of Saudi Arabia.

Yanbu Industrial City has become the third largest refinery centre in the world. It has also established the largest petroleum transportation port near the Red Sea.

Agreement between National Industrial Development Centre and EV Metals Group

On 22 December 2020 the National Industrial Development Centre (NIDC) and EV Metals Group plc (EVM) signed a non-binding Memorandum of Understanding (MoU) for the development of a Battery Chemicals Complex and a Saudi supply chain in the Kingdom of Saudi Arabia.

The MOU provides for up-stream integration through the development of a Saudi supply chain by exploration for and mining and processing of economic deposits of mineral resources containing critical raw materials including lithium, nickel, cobalt, copper, platinum group metals and rare earth elements for downstream processing at the Battery Chemicals Complex in KSA.

About NIDC

The National Industrial Development Centre (NIDC) is the specialized industrial investment attraction & industrial development organization at the centre of the transformation of Saudi Arabia’s industrial sector, creating new industries to diversify the economy and meet vision 2030 ambitions.

The mission of NIDC is to facilitate the growth and diversification of the Kingdom’s manufacturing and industrial base by, among other activities, fostering partnerships between local Kingdom entities and international manufacturers to grow and diversify the Saudi Arabian economy.